If you’re contemplating enhancing your home’s heating and cooling system in Flat Rock, NC, the Inflation Reduction Act (IRA) provides substantial tax credits and rebates. Available incentives will help you slash your monthly energy expenses and access significant rebates and tax benefits, all while enjoying a fresher, healthier indoor atmosphere.

How Are Heat Pumps Different From Traditional HVAC?

Heat pumps work by transferring heat from one area to another. In colder months, they extract warmth from the outdoors and transfer it indoors, while during warmer months, they perform the reverse process.

A traditional HVAC system uses separate units for heating and cooling: a furnace, typically powered by natural gas or oil, for heating and an air conditioner for cooling. While both systems maintain comfortable indoor temperatures, heat pumps are generally more energy-efficient, as they simply move heat rather than generate it. Because these are so energy efficient, the rebates and tax credits for heat pumps are even greater than with traditional HVAC.

Traditional HVAC

If you opt against a heat pump, modern, efficient air conditioners can still offer substantial savings on your energy bill and help reduce carbon emissions. For certain homes, a heat pump may not be the ideal solution due to the property’s layout or surrounding climate. In such cases, an energy-efficient furnace might be more suitable.

Consult the HVAC experts at Champion Comfort Experts for our recommendations about what works best here in the Flat Rock, NC area. If you’re considering upgrading your furnace, take advantage of the Inflation Reduction Act’s tax credits, which could save you up to $600 on installation and offer future savings on energy bills going forward.

The Inflation Reduction Act: HVAC and Heat Pump Savings

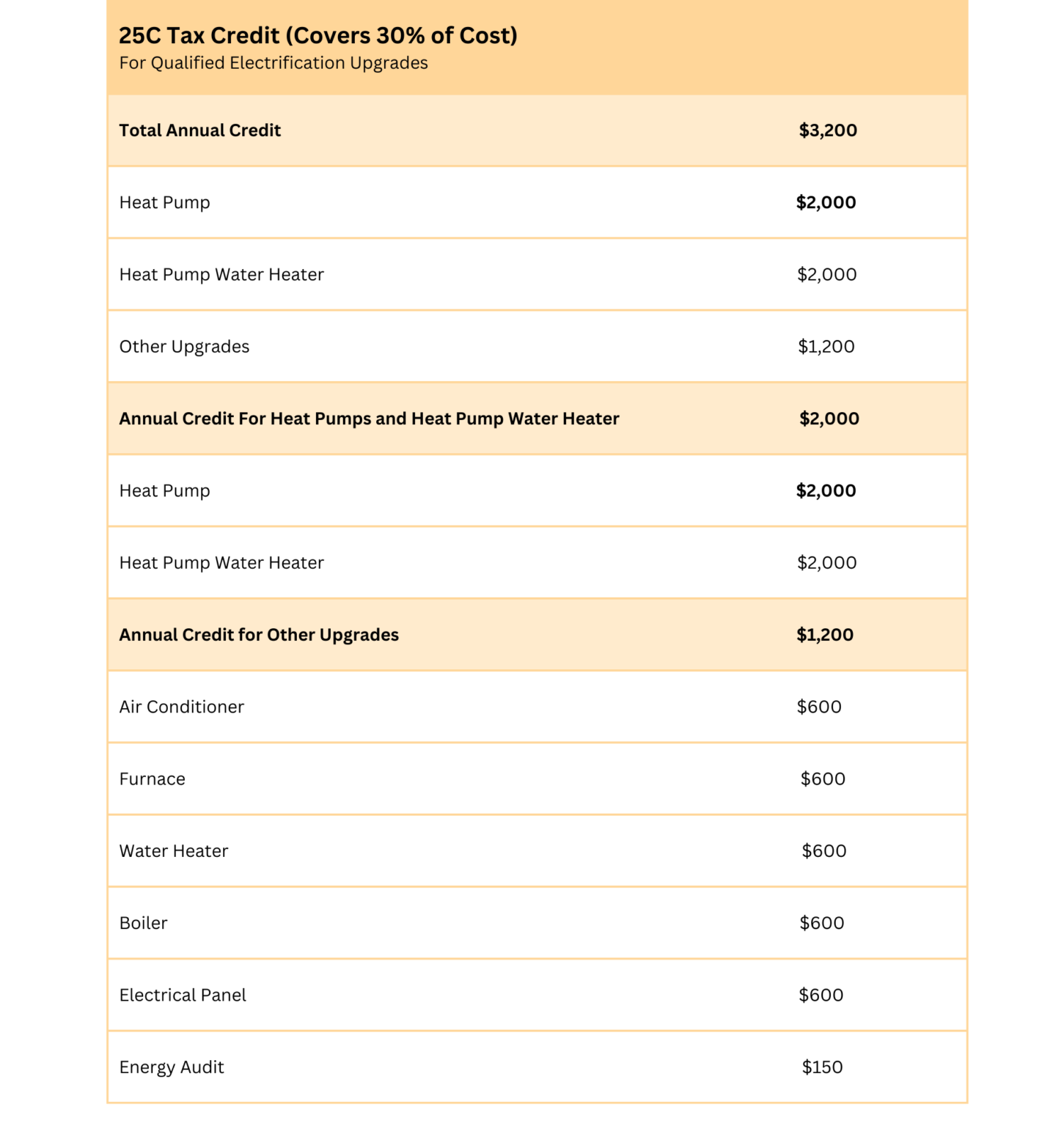

The IRA has expanded and extended tax credits and deductions, including the 25C Energy Efficiency Home Improvement Tax Credit. For 2023, the 25C tax credit now covers 30% of the cost of new energy-efficient systems for all homeowners. You can save even more if you qualify as a low- or moderate-income household.

If you’re looking for a heat pump installation or HVAC upgrade, know you can deduct 30% of your total costs when you file your taxes. There’s a cap of $3,200 in total tax credits, and the maximum for a heat pump is $2,000. You’ll also be able to get rebates of up to $8,000 (for low- to middle-income households) for reducing your energy usage by 35% or more.

Contact Us to Learn More

Reach out to Champion Comfort Experts today to find out more. We can help you understand all your options and exactly what you’ll save by prioritizing an energy-efficient home.

*Disclaimer: Champion Comfort Experts does not guarantee the availability of tax credits or rebate funds, nor the specific rebate or credit amounts that may be available to each individual. Rebates and tax credits are subject to change and may vary depending on factors such as geographic location, income level, and the specific details of the heating and cooling system being installed. In addition, please note that the information provided by “brand name” regarding tax credits is for general informational purposes only and should not be considered tax advice. Homeowners should consult with a qualified tax advisor to determine their eligibility for tax credits and to receive specific advice on their individual tax situation. “Brand Name” is not responsible for any errors or omissions in the information provided, and we make no guarantees or warranties regarding the availability or applicability of any tax credits or rebates.