The Inflation Reduction Act offers significant savings on new equipment and installation costs, meaning that homeowners needing or wanting to handle significant household issues can save money while upgrading to energy efficient units. With the different rebates, incentives, and tax credits included in the IRA, living comfortably and sustainably becomes more affordable.

Savings on HVAC, Electrical, and Plumbing Services

If your home’s older than 25 years old with original wiring, your home probably isn’t operating as efficiently or safely as it should be. Older households with older wiring are at a higher risk for safety hazards, like home fires. If your HVAC unit is old, outdated, or experiencing important issues, a new system installation is needed.

If your water heater is taking up more energy and water than usual in order to properly function, then it’s time for an energy efficient upgrade. Installing heat pump water heaters and replacing your HVAC unit are all home upgrades that can feel financially overwhelming.

What Does the Inflation Reduction Act Do?

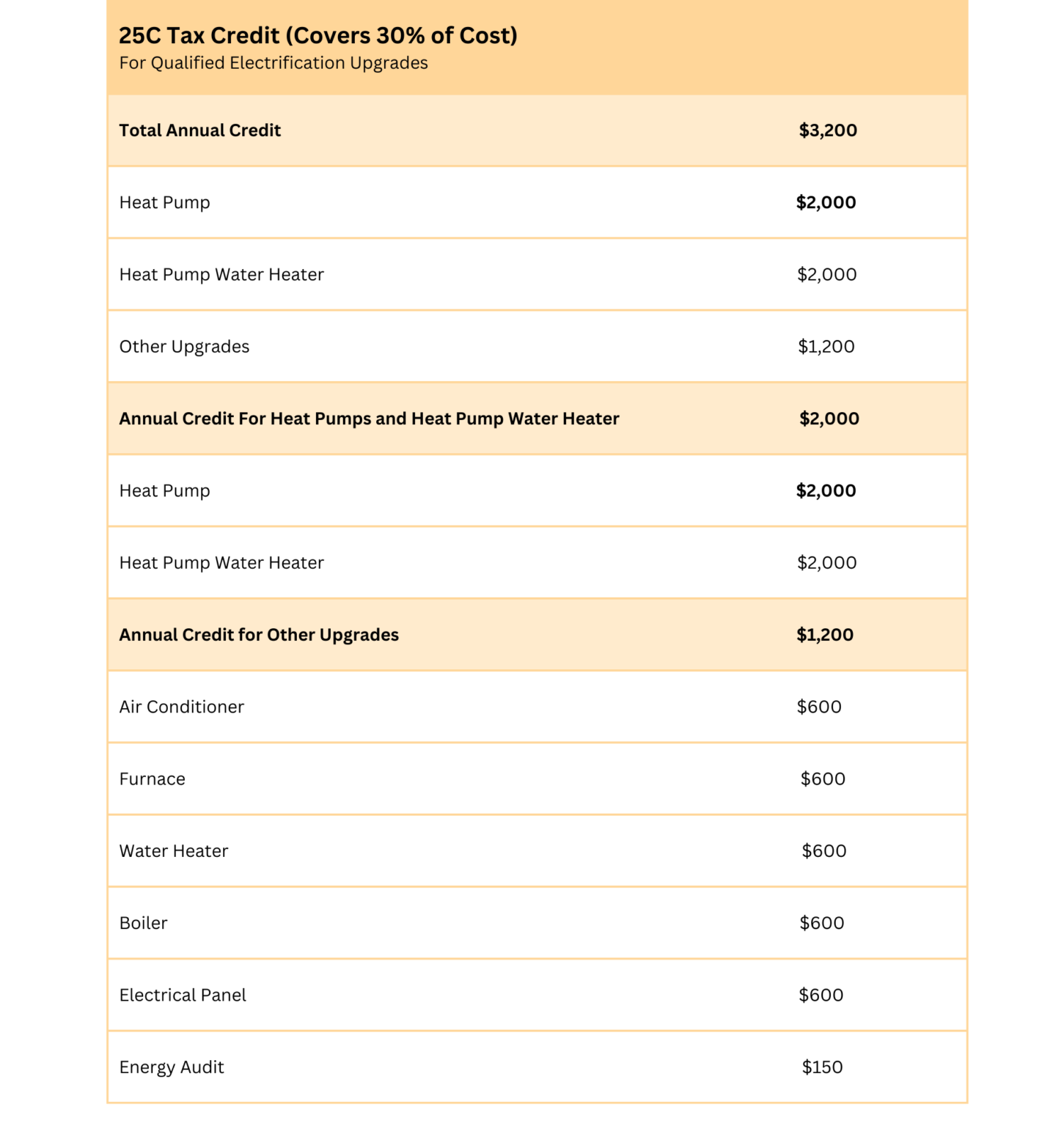

Tax savings are always a welcome benefit, and starting January 1st, 2023, the Inflation Reduction Act offers credits for households who make upgrades that will reduce their energy and water bills. The Energy Efficient Home Improvement Tax Credit expands upon existing tax credits. Where previously the credit was only $500 over a lifetime, homeowners can now deduct up to 30% of the total cost of specific home improvements with a rebate of up to $3,200.

What Qualifies?

It is important to note that upgrades must meet applicable Consortium for Energy Efficiency and Energy Star requirements to qualify for a tax credit. We have all the information you need to understand what qualifies, including which upgrades can return the best rebates. We’ll also help you with the paperwork.

The HOMES Rebate (Home Owner Managing Energy Savings Rebate)

In addition to tax incentives, the HOMES rebate program provides homeowners with financial incentives of $2,000 to $8,000 for making comprehensive energy efficiency improvements in their home, from plumbing to electric to HVAC.

The HOMES rebate program is accessible to all homeowners, but low- and middle-income households can earn greater rewards and savings. Low- and middle-income households can receive up to $8,000 or 80% of the project cost. In comparison, high-income households are eligible for up to $4,000 or 50% of the project cost.

High-Efficiency Electric Home Rebate (HEEHRA)

The HEEHRA program is for low- and middle-income homeowners, giving them instant savings at the moment of sale. With this program, households can save as much as $14,000 on energy-efficient improvements. The program covers the entire cost of electrification for low-income households, while covering 50% of expenses for moderate-income households.

Eligible expenses include equipment and professional installation charges.

The Energy Efficient Home Improvement Tax Credit

This tax credit is also included in the IRA, allowing up to a 30% deduction for homeowners making energy efficient upgrades — a maximum rebate of $3200. Upgrades must adhere to the Consortium For Energy Efficiency and Energy Star requirements to qualify.

We can help you take advantage of every incentive, rebate, and tax credit mentioned above. Call Champion Comfort Experts at 828-490-9700 today for more details. You’ll do a favor for the planet and your wallet as greater energy efficiency lowers your monthly bills.

*Disclaimer: Champion Comfort Experts does not guarantee the availability of tax credits or rebate funds, nor the specific rebate or credit amounts that may be available to each individual. Rebates and tax credits are subject to change and may vary depending on factors such as geographic location, income level, and the specific details of the heating and cooling system being installed. In addition, please note that the information provided by “brand name” regarding tax credits is for general informational purposes only and should not be considered tax advice. Homeowners should consult with a qualified tax advisor to determine their eligibility for tax credits and to receive specific advice on their individual tax situation. “Brand Name” is not responsible for any errors or omissions in the information provided, and we make no guarantees or warranties regarding the availability or applicability of any tax credits or rebates.