Upgrading electrical or plumbing equipment in your home will benefit you in the long run, but the upfront costs can cause stress, especially if they strain your budget. However, thanks to the Inflation Reduction Act, area homeowners can benefit from electrical and plumbing savings in Flat Rock, NC, on upgrades and repairs that meet specific criteria.

How Homeowners Can Benefit From Electrical and Plumbing Savings in Flat Rock, NC With the Inflation Reduction Act

Your electrical and plumbing systems are non-negotiable, meaning you need them to be operational and fully functional to promote the best quality of life. If you’re facing plumbing or electrical issues or need to replace equipment that isn’t working as efficiently as it should or once did, you can make the necessary repairs or replacements without significantly affecting your budget.

Saving Money on Electrical and Plumbing Repairs and Upgrades

The Inflation Reduction Act, also known as the IRA, provides homeowners savings and tax credits for making particular repairs or upgrades that increase energy efficiency and promote reduced energy usage. While the IRA was designed with the environment in mind, homeowners also benefit by saving money on equipment, installation, and labor costs. Built within the IRA are different ways to save that benefit all homeowners, including extra savings for those who qualify as lower to middle-income homeowners.

Electrical Repairs and Upgrades

One way homeowners can benefit from the IRA is by upgrading their home’s electrical panel. Homes older than 25 years without an updated electrical panel qualify for the necessary upgrade. Homeowners who want to upgrade their electrical panel will save money and make their homes safer in the process. Installing an up-to-date electrical panel in your home and removing outdated wiring can reduce the risk of possible electrical overload, fire, or outages.

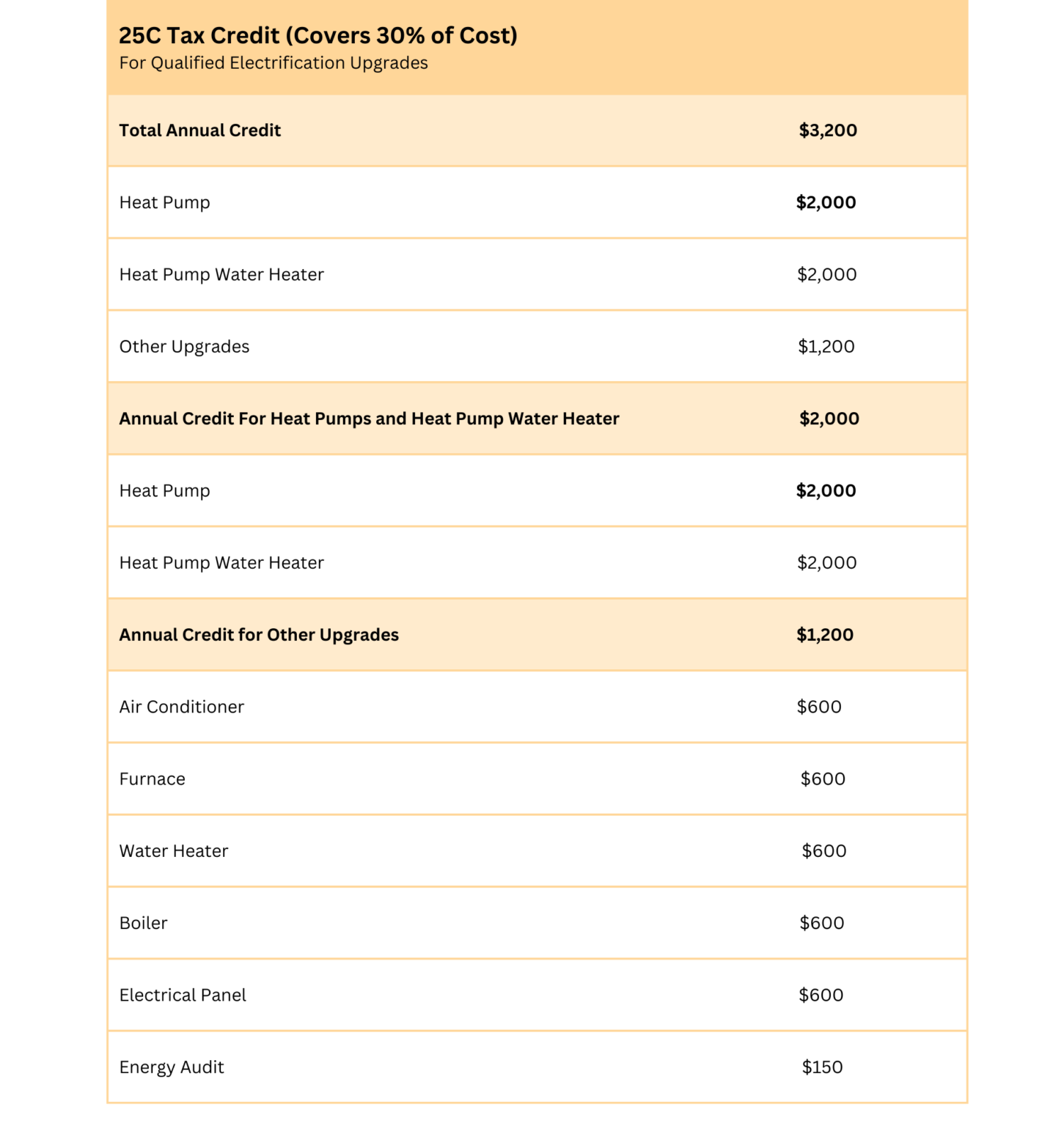

You can also use the 25C Energy Efficiency Home Improvement tax credit to save up to $600 on this upgrade. Replacing your breaker box, scheduling electrical rewiring, and investing in an electric stove or cooktop also qualify for reimbursement under the IRA.

Plumbing Upgrades and Equipment Replacement

If your plumbing system needs upgrades to promote energy efficiency, now is the time to take advantage of the Energy Efficiency Home Improvement tax credit. When you make the qualifying updates to your plumbing system, you can save up to $3,200 per year by claiming this tax credit on your federal tax return. Some plumbing upgrades and repairs that qualify for the IRA tax credit include a heat pump water heater installation, among others.

If your home needs energy-efficient upgrades or repairs to make it safer and help you save money on energy bills, we can give you more details about how you can benefit from the Inflation Reduction Act and our services. Contact us today at Champion Comfort Experts to learn more.

*Disclaimer: Champion Comfort Experts does not guarantee the availability of tax credits or rebate funds, nor the specific rebate or credit amounts that may be available to each individual. Rebates and tax credits are subject to change and may vary depending on factors such as geographic location, income level, and the specific details of the heating and cooling system being installed. In addition, please note that the information provided by “brand name” regarding tax credits is for general informational purposes only and should not be considered tax advice. Homeowners should consult with a qualified tax advisor to determine their eligibility for tax credits and to receive specific advice on their individual tax situation. “Brand Name” is not responsible for any errors or omissions in the information provided, and we make no guarantees or warranties regarding the availability or applicability of any tax credits or rebates.